The DMJPS Digest: A CPA Blog

Insights and musings from the desk of DMJPS professionals.

Financial Accounting Blogs for Businesses & Individuals

Are you perplexed by new tax laws and need advice on how to comply with the latest regulations? Do you want to improve your financial literacy so you can run a more efficient and profitable business? You’ve come to the right place. DMJPS PLLC’s accounting blog provides the latest insights and expert knowledge to help your business navigate a complex and ever-evolving industry.

DMJPS’ team of highly-experienced specialists provides expert advice and in-depth analysis of the latest news, trends, practices, and regulations to help you stay up-to-date on the most current developments. DMJPS’ accounting blog covers the most important financial reporting issues that affect many individuals, businesses, and organizations.

North Carolina Economic Report – 2023 Fourth Quarter

Highlights: DMJPS is pleased to provide a statewide quarterly economic report with highlights of North Carolina’s fifteen metros for the fourth Quarter of 2023. Indicators suggest the state maintained a steady growth pattern, although this was largely moderate. • In...

The New Credit Loss Model’s Effect on Small Business and Nonprofit Organizations

There is a new accounting standard effective during 2023 which will change how companies account for future losses on financial instruments. If this sounds abstract, then you are not alone. The standard was initially developed to change the way that banks account for...

Changes in the Tax Laws: What to Know Before Filing Your 2024 Return

The IRS officially began accepting returns for the 2023 tax year at the end of January 2024. This gives taxpayers several months to complete their returns or submit an extension request. Every year, the IRS makes changes to various aspects of the tax filing process,...

Accounting Internship

DMJPS is looking to hire a full time Office Administrator for our Durham, NC office. Candidates must have excellent organization, communication and problem solving skills, and at least 3 years of experience in office administration.

CPA Firm DMJPS PLLC Raises $12,825 for Special Olympics North Carolina

One of the region’s most unique fundraising events took place on Saturday, February 24 in Greensboro at Wet n’ Wild Emerald Point. The Triad Chill Polar Plunge for Special Olympics was held on a frigid afternoon with hundreds of community supporters in attendance....

DMJPS PLLC Wins ClearlyRated’s 2024 Best of Accounting Award for Service Excellence

DMJPS, a U.S. Top 200 CPA and business advisory firm, announced today that they have won the Best of Accounting Award for providing superior service to their clients. ClearlyRated's Best of Accounting® Award winners have proven to be industry leaders in service...

Revisions to the Form 5500 and New Provisions from Secure 2.0

There are new law changes by the United States Department of Labor (DOL), IRS, Pension Benefit Guaranty Corporation(PBGC) and Secure Act 2.0 as regards to employee benefit plans. Employee benefit plans generally are required to file annual returns/reports about, among...

Tax Reporting: 1099 Forms and Their Significance in Recording Financial Transactions

There are several types of 1099 forms, such as 1099-NEC (Nonemployee Compensation payments to independent contractors) and 1099-Misc (Miscellaneous Income payments), used for reporting transactions that occurred during the previous tax year. These informational...

North Carolina Economic Report – 2023 Third Quarter

Highlights: DMJPS is pleased to provide a statewide quarterly economic report with highlights of North Carolina’s fifteen metros for the 3rd quarter of 2023. Indicators suggest the state has maintained its standing and experienced overall steady growth compared to a...

IRS Issues Penalty Relief

As part of our commitment to keeping you informed, we're providing a few vital updates from the IRS that may positively impact your tax situation. Update: IRS Announces New Penalty Relief Program In response to the challenges of the COVID-19 pandemic, the IRS has...

Stay in the Know With DMJPS’ Business Accounting Articles

The world of finance and reporting often has many complex regulations that can frustrate even the best in the industry. DMJPS can simplify complicated issues to improve your understanding and help you make informed decisions. Our accounting blogs provide businesses and individuals with a wealth of guidance, insightful content, and actionable solutions to reduce impediments on your path to growth.

If you want to stay ahead of the latest developments and gain the most comprehensive insight into the world of accounting, invest your time in reading our CPA blog. DMJPS’ business accounting articles are written by our team of nationally-acclaimed specialists, offering educational resources, strategic advice, and practical solutions to help you fulfill your most pressing financial and tax obligations.

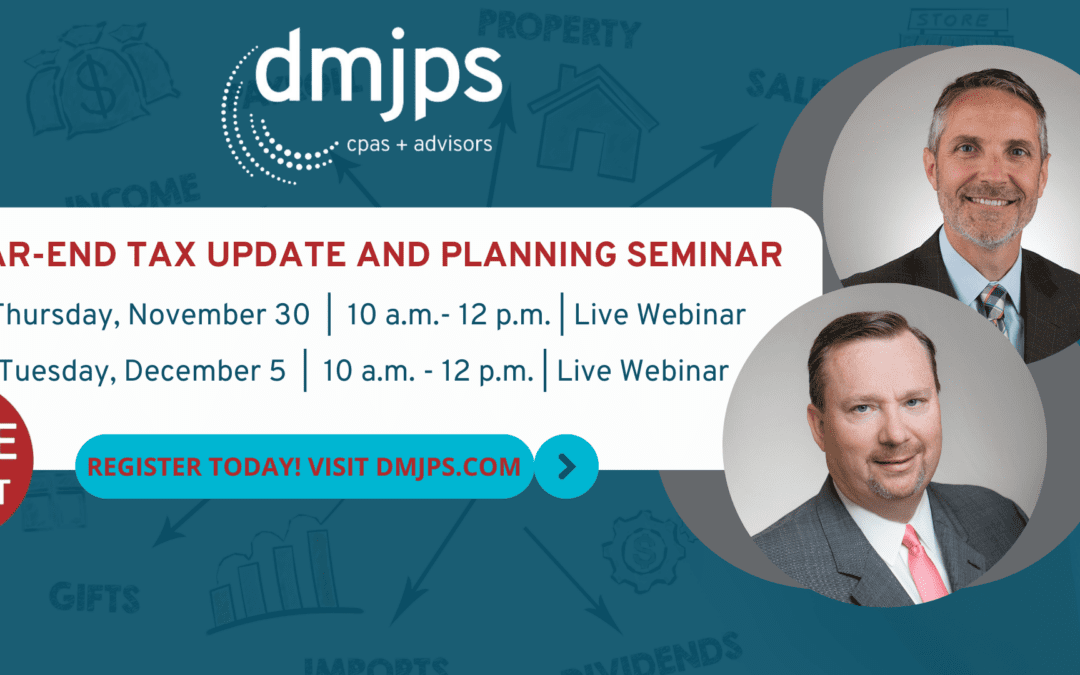

DMJPS Webinars

WEBINAR: Year-End Tax Planning and Updates

Thursday, November 30 & Tuesday, December 5 | 10 a.m. - 12 p.m. Presented by R. Milton Howell III, CPA, CSEP, Partner, Director of Tax Services & Rollin Groseclose, CPA, CGMA, Partner, Director of Tax Services.

Tax Watch

The New Credit Loss Model’s Effect on Small Business and Nonprofit Organizations

There is a new accounting standard effective during 2023 which will change how companies account for future losses on financial instruments. If this sounds abstract, then you are not alone. The standard was initially developed to change the way that banks account for...

Changes in the Tax Laws: What to Know Before Filing Your 2024 Return

The IRS officially began accepting returns for the 2023 tax year at the end of January 2024. This gives taxpayers several months to complete their returns or submit an extension request. Every year, the IRS makes changes to various aspects of the tax filing process,...

Revisions to the Form 5500 and New Provisions from Secure 2.0

There are new law changes by the United States Department of Labor (DOL), IRS, Pension Benefit Guaranty Corporation(PBGC) and Secure Act 2.0 as regards to employee benefit plans. Employee benefit plans generally are required to file annual returns/reports about, among...